Select the “Loan” radio button and press "Continue". You should have a window that looks like this:

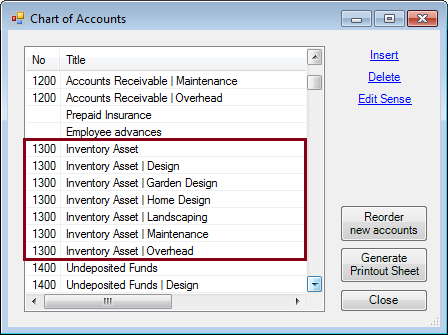

At the bottom right hand corner of the Chart of Accounts window is a bottom labeled “Account”. Find the new account dialog box by clicking on the “Lists” command at the top of the screen and selecting “Chart of Accounts”. The liability is set up by adding an account to the Chart of Accounts. Follow these steps to properly record the debt and the equipment purchase: To illustrate, let’s say the company purchased a manufacturing press at a total equipment cost $120,000. This amount should be recorded as of the day the loan was originated or the beginning of the fiscal year if the debt was originated before QuickBooks was set up. This article will assist QuickBooks users in correctly recording both the original transaction that generated the loan and new asset, as well as recording the loan payments subsequent to the purchase date.ĭebt is recorded on the balance sheet at the principal value. A common mistake I see users of QuickBooks make is how debt or loans are recorded in QuickBooks and how payments are made to that debt.

0 kommentar(er)

0 kommentar(er)